27+ Chapter 6 A Of Income Tax

130 An individual who is resident in Canada on the basis of the factors discussed in 110 to 115 or 125 to 127. E Gross income for telecommunications providers is subject to the provisions of Article 20 Chapter 9 Title 58.

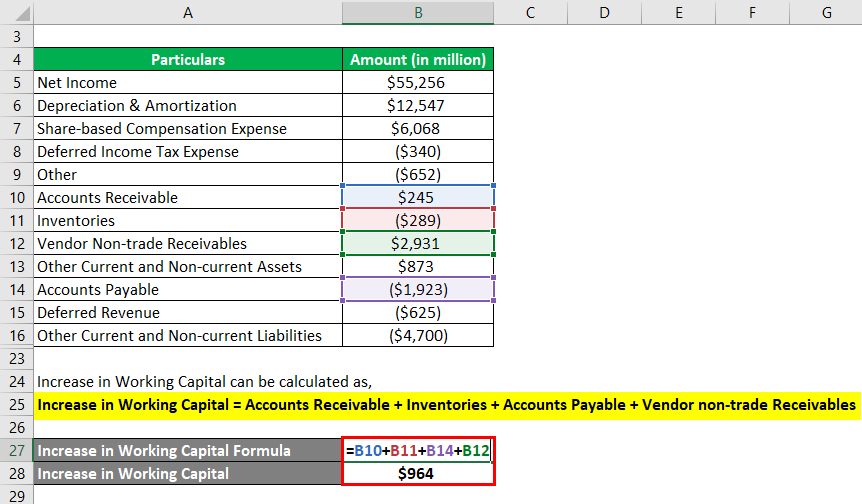

Operating Cash Flow Formula Examples With Excel Template Calculator

Web This Folio Chapter provides tax professionals and individuals with a technical overview of the Canada Revenue Agencys application of the federal income tax rules related to scholarships research grants and other education assistance.

. Tax rates as per Income-tax Act vis-à-vis tax treaties. Taxpayers need not file an income tax return D. 327 The nature and characterization of the amount received must be determined on a case-by-case basis.

Provision for Income tax made during the year 2018 was Rs. Web Subsection 1812 23 In computing an individuals income from a business for a tax year subsection 1812 provides that no deduction may be claimed for expenses related to the use of any part referred to in the Chapter as a work space of a self-contained domestic establishment where the individual resides unless certain conditions are met. Also discussed are various other provisions of the Act relating to interest deductibility.

19 The vendor is deemed to dispose of the exchanged. 332 RE 2019 9 _____ CHAPTER 332 _____ THE INCOME TAX ACT An Act to make provisions for the charge assessment and collection of Income Tax for the ascertainment of the income to be charged and for matters incidental thereto. TDS rates under DTAA.

An additional refundable tax of 10 23 is levied on the investment income other than deductible dividends of a CCPC. Web A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Web Study with Quizlet and memorize flashcards containing terms like 1.

California voters have now received their mail ballots and the November 8 general election has entered its final stage. In this way they are designed to reduce carbon dioxide CO 2 emissions by increasing. Web Digital Commerce 360 offers daily news and expert analysis on retail ecommerce as well as data on the top retailers in the world.

Have a question about per diem and your taxes. Nearly 10000 migrants moved from El Paso as daily crossings ease. Web Manufacturers include those taxpayers reporting a manufacturing principal business activity code on their federal income tax returns.

Web Trumps tax returns show he paid no taxes in 2020 according to the panel. Amid rising prices and economic uncertaintyas well as deep partisan divisions over social and political issuesCalifornians are processing a great deal of information to help them choose state constitutional. It covers all items of passive income fim whatever sources B.

Carbon taxes are intended to make visible the hidden social costs of carbon emissions which are otherwise felt only in indirect ways like more severe weather events. Papers from more than 30 days ago are available all the way back to 1881. 11 For tax purposes section 3 brings into income a taxpayers income from all sources inside or outside of Canada whether or not the particular source is enumerated in section 3 and including sources that are not specifically described in this Chapter and the taxable portion of capital gains net of allowable capital lossesIn addition section 3 and.

Web During the year Income Tax paid was Rs. Web Tax Questions. Web Latest news from around the globe including the nuclear arms race migration North Korea Brexit and more.

622 Financial institutions that are required to perform due diligence procedures under both Part XVIII and. Prepare Provision for Income Tax Account from the following informations for preparing Cash Flow Statements. 18 Unless the vendor chooses to include any portion of the gain or loss in income for the tax year in which the exchange occurred the rollover provisions of subsection 8511 apply automatically to the exchange and no election is required to be filed.

Part XVIII and Part XIX of the Income Tax Act. GSA cannot answer tax-related questions or provide tax advice. Web Tax consequences to the vendor.

Web Line 604 Refundable tax on CCPCs investment income. Web A New York Times 1 Bestseller An Amazon 1 Bestseller A Wall Street Journal 1 Bestseller A USA Today Bestseller A Sunday Times Bestseller A Guardian Best Book of the 21st Century Winner of the Financial Times and McKinsey Business Book of the Year Award Winner of the British Academy Medal Finalist National Book Critics Circle Award It. Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov.

There is a fee for seeing pages and other features. 9821 327b1 inserted in text following last numbered paragraph a provision that nothing in the regulations prescribed for purposes of chapter 24 relating to income tax withholding which provides an exclusion from wages as used in such chapter shall be construed to require a similar exclusion from wages in regulations. Web The Income Tax Act CAP.

Web Key Findings. Web Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. Transfer Pricing as contained in Chapter X of Income-tax Act 1961.

It applies to all items of gross income of any non-resident earned feom sources within the Philippines C. Web The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card. 127 It is a further requirement.

This additional tax may be part of the refundable portion of Part I tax on line 450 and would be added to the refundable dividend tax on hand RDTOH or for tax years starting after. Which is correct with regard to final income taxation. 11 of 2004 15 of 2004 13 of 2005 6 of 2006 16 of 2007 1 of 2008 13 of 2008 14.

Web This Folio Chapter provides tax professionals businesses and individuals with a technical overview of the Canada Revenue Agencys position on the deductibility of interest expense under paragraph 201c. Web This Folio Chapter provides tax professionals and individuals with a technical overview of the Canada Revenue Agencys views on the determination of an individuals residence status for federal income tax purposes. Amount may be paid or deposited any time during the previous year but the deduction shall be available on so much of the aggregate of sums as do not exceed the total income chargeable to tax during the previous year.

2 Gross income for business license tax purposes may not include taxes collected for a. Web The sums paid or deposited need not be out of income chargeable to tax of the previous year. Web 66 This chapter discusses certain common concepts that support the due diligence and identification processes that are covered in more detail in Chapters 7 8 and 9 of this guidance.

Web Corporate tax is imposed in the United States at the federal most state and some local levels on the income of entities treated for tax purposes as corporations. Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 following the passage of the Tax Cuts and Jobs Act of 2017State and local taxes and.

Vigilance Pnb Vigilance

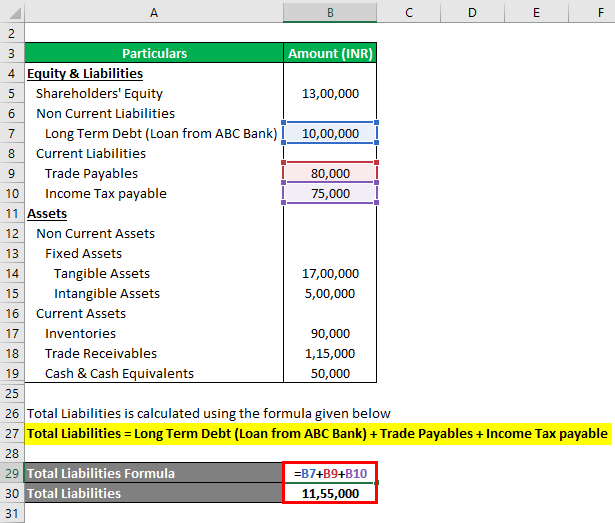

Net Asset Formula Examples With Excel Template And Calculator

Deductions Under Chapter Vi A Of Income Tax Act Know How Much Tax May Be Saved The Financial Express

Pdf Accounting Management Decision Tool In Business

Pdf Tax Ratios A Critical Survey

April 27 2016 By Julie Becker Issuu

G35954kq03i003 Jpg

What Are The Deductions Available Under Chapter Vi A Of Income Tax Act Individuals And Huf Youtube

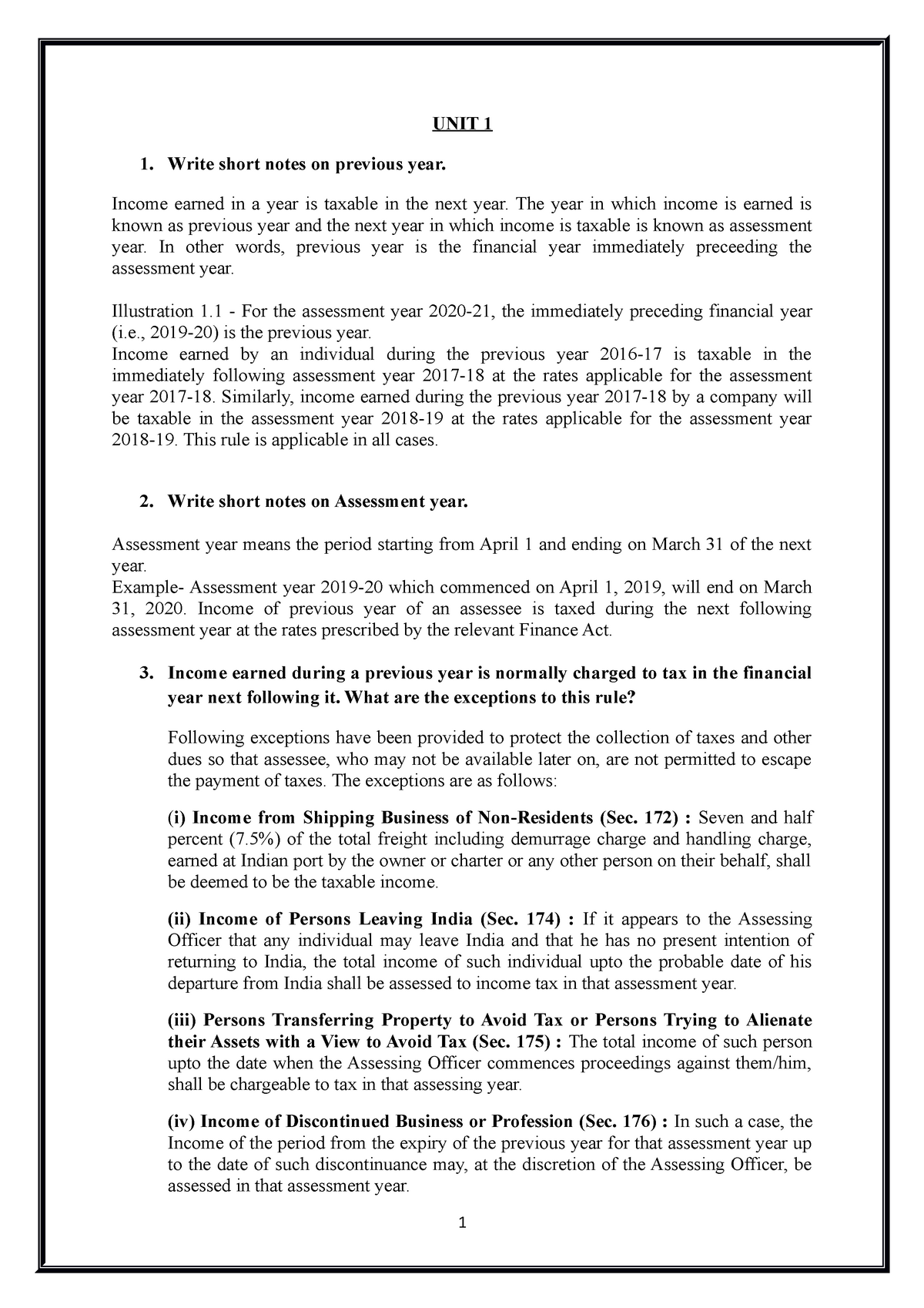

Unit 1 Unit 1 Unit 1 1 Write Short Notes On Previous Year Income Earned In A Year Is Taxable Studocu

瑞信 全球基础设施行业 丰富的活动正在加速 传达碳捕获和储存的背景 悟空智库

Income Tax Act 1961 Basics That You Need To Know

Bellingham City Council Public Comment Transcription Project January 11 2021 Through March 8 2021 Noisy Waters Northwest Noisy Waters Northwest

Income Tax Act 1961 Basics That You Need To Know

Ws Apr 23 2021 By Weekly Sentinel Issuu

Chapter Two Cost Concepts And Behavior Study Tips

Digiworld Yearbook 2008

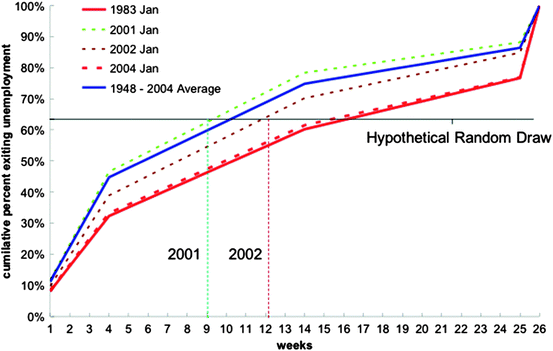

Simulation Design For Policy Audiences Informing Decision In The Face Of Uncertainty Springerlink